Matthew Gardner’s Top 10 Predictions for 2023

This video shows Windermere Chief Economist Matthew Gardner’s Top 10 Predictions for 2023. Each month, he analyzes the most up-to-date U.S. housing data to keep you well-informed about what’s going on in the real estate market.

Matthew Gardner’s Top 10 Predictions for 2023

1. There Is No Housing Bubble

Mortgage rates rose steeply in 2022 which, when coupled with the massive run-up in home prices, has some suggesting that we are recreating the housing bubble of 2007. But that could not be further from the truth.

Over the past couple of years, home prices got ahead of themselves due to a perfect storm of massive pandemic-induced demand and historically low mortgage rates. While I expect year-over-year price declines in 2023, I don’t believe there will be a systemic drop in home values. Furthermore, as financing costs start to pull back in 2023, I expect that will allow prices to resume their long-term average pace of growth.

2. Mortgage Rates Will Drop

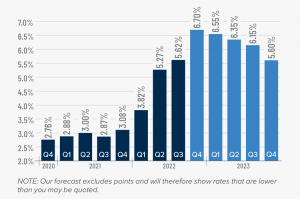

Mortgage rates started to skyrocket at the start of 2022 as the Federal Reserve announced their intent to address inflation. While the Fed doesn’t control mortgage rates, they can influence them, which we saw with the 30-year rate rising from 3.2% in early 2022 to over 7% by October.

Their efforts so far have yet to significantly reduce inflation, but they have increased the likelihood of a recession in 2023. Therefore, early in the year I expect the Fed to start pulling back from their aggressive policy stance, and this will allow rates to begin slowly stabilizing. Rates will remain above 6% until the fall of 2023 when they should dip into the high 5% range. While this is higher than we have become used to, it’s still more than 2% lower than the historic average.

3. Don’t Expect Inventory to Grow Significantly

Although inventory levels rose in 2022, they are still well below their long-term average. In 2023 I don’t expect a significant increase in the number of homes for sale, continue reading

Q3 2022 Idaho Real Estate Market Update

The following analysis of select counties of the Idaho real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

Employment in Idaho continues to grow, but the pace has started to taper. The addition of 22,400 jobs over the past 12 months represents a growth rate of 2.8%. Idaho’s third-quarter unemployment rate was 2.7%, down from 3.5% a year ago. This is higher than the all-time low in May and June of this year, but very impressive all the same. Although jobs are being added at a slower pace, I am not concerned given the current unemployment rate and the growing labor force.

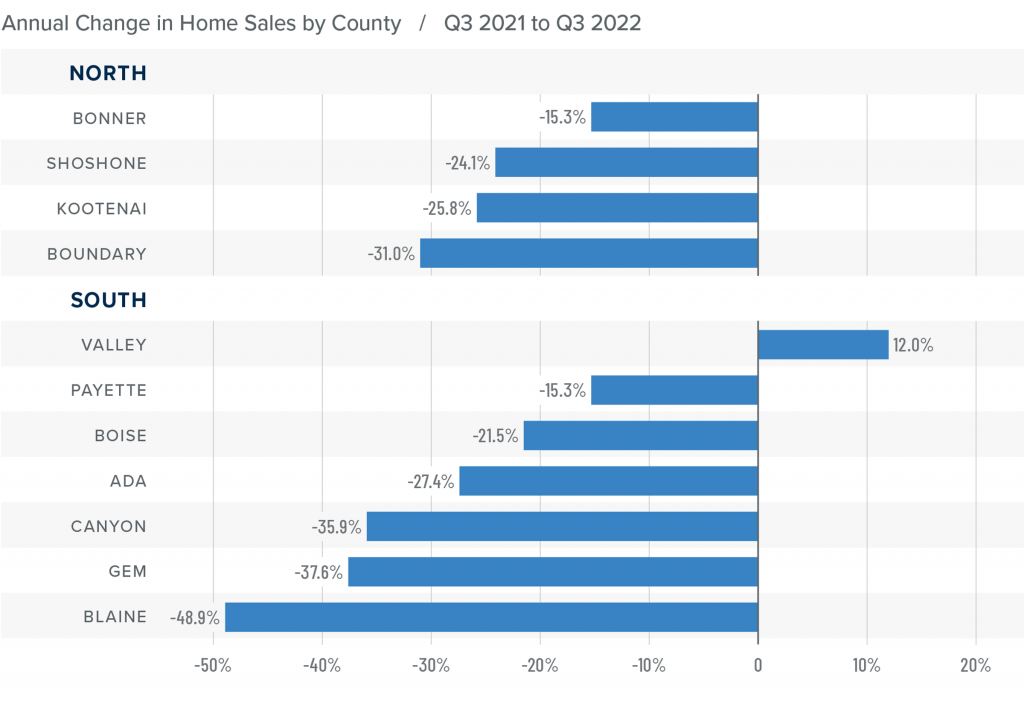

Idaho Home Sales

❱ In the third quarter of 2022, 5,243 homes sold, which was 28.7% lower than a year ago and 18.1% lower than in the second quarter of the year.

❱ Listing activity was up 53% compared to a year ago. The average number of homes on the market was 9.1% higher than in the second quarter of 2022.

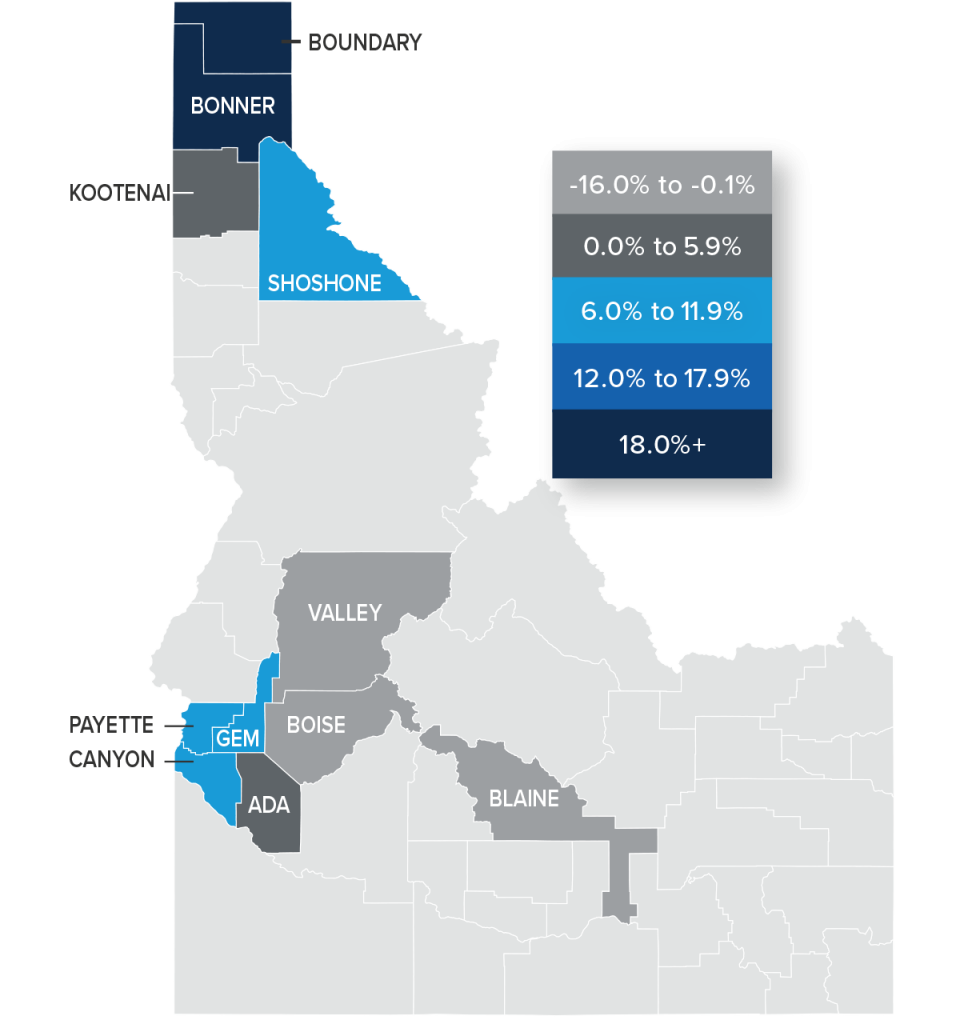

❱ Compared to the same period a year ago, sales fell in the northern part of the state and were lower in all areas of Southern Idaho except Valley County. Compared to the second quarter, sales also fell across Northern Idaho, but rose in Valley, Payette, and Boise counties in the southern part of the state.

❱ Pending sales were 19% lower than in the second quarter of this year. With more listings and fewer sales, the market is certainly slowing, much of which can be attributed to rising mortgage rates, which hit a level we have not seen since 2008.

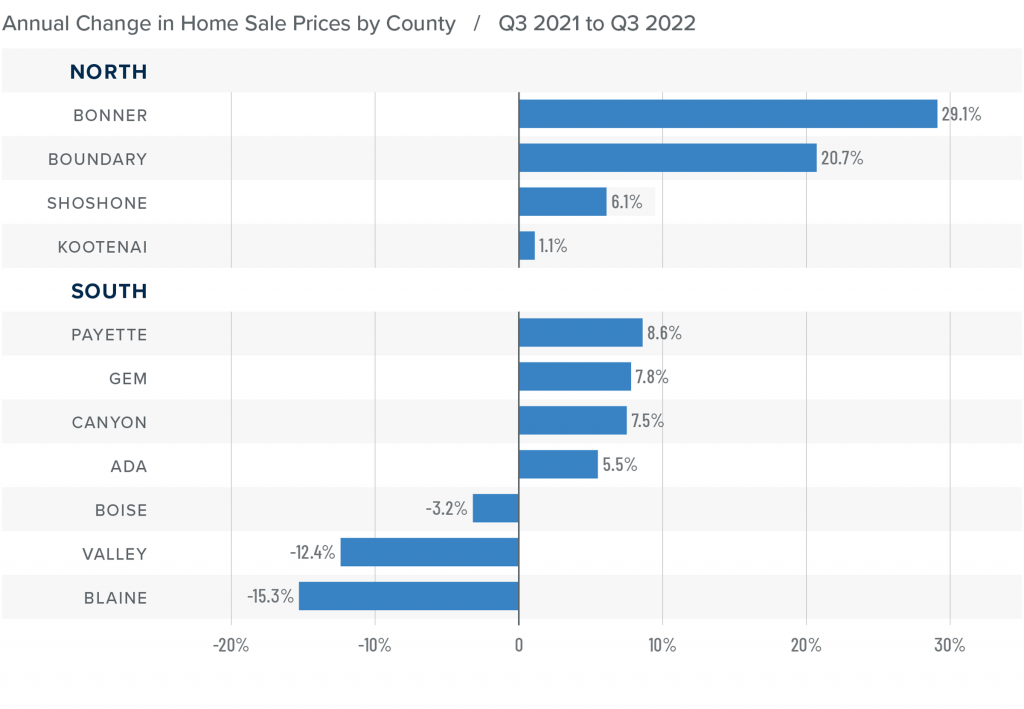

Idaho Home Prices

❱ The average home price in the region rose 4.3% year over year to $625,275 but was down 2.9% compared to the second quarter of the year.

❱ Compared to the second quarter of 2022, prices rose in all Northern Idaho counties except Kootenai, where they were down 1.7%. In the southern part of the state, prices fell across the board.

❱ Prices rose by double digits in Bonner and Boundary counties, while the balance of Northern Idaho counties saw single-digit growth. In the southern part of the state, prices rose in four of the counties, but fell in Boise, Valley, and Blaine counties.

❱ Median listing prices in the second quarter were lower in all southern markets, but higher in all but Bonner County in the northern part of the state.

Mortgage Rates

This remains an uncertain period for mortgage rates. When the Federal Reserve slowed bond purchases in 2013, investors were accused of having a “taper tantrum,” and we are seeing a similar reaction today. The Fed appears to be content to watch the housing market go through a period of pain as they throw all their tools at reducing inflation.

As a result, mortgage rates are out of sync with treasury yields, which not only continues to push rates much higher, but also creates violent swings in both directions. My current forecast calls for rates to peak in the fourth quarter of this year before starting to slowly pull back. That said, they will remain in the 6% range until the end of 2023.

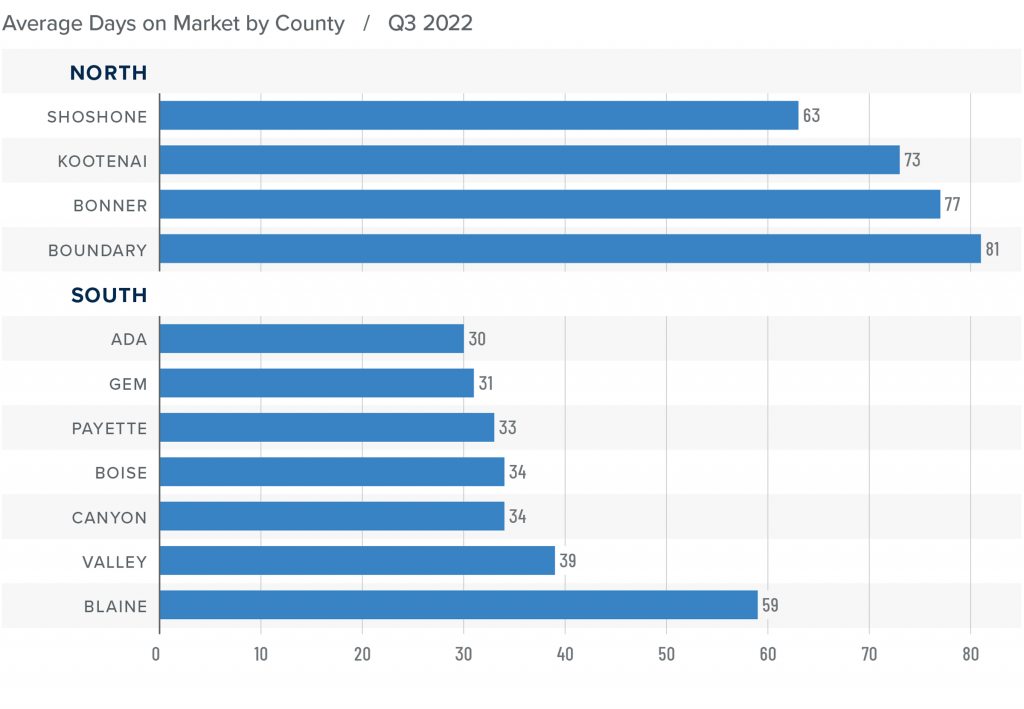

Idaho Days on Market

❱ The average number of days it took to sell a home in the region rose five days compared to the same quarter of 2021 but fell six days compared to the second quarter of 2022.

❱ In Northern Idaho, days on market rose in all counties other than Kootenai compared to a year ago. Market time rose in every county other than Blaine in Southern Idaho.

❱ It took an average of 74 days to sell a home in Northern Idaho, and 37 days in the southern part of the state.

❱ Homes sold the fastest in Ada County in the southern part of the state and in Shoshone County in Northern Idaho.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The third quarter appears to have been an inflection point: the impact of higher mortgage rates and lower affordability have now started to negatively affect home sales and prices. With mortgage rates likely to remain very high compared to recent years, the massive run-up in home values is at an end. Although the market will continue to be negatively impacted as we move through the winter and into the spring, I don’t see it falling in a manner similar to the Great Recession. Owners are sitting on significant equity. Even if prices fall in 2023, which I expect, the decline will be relatively modest.

With a contracting market, I expect that many homeowners who were thinking about selling will decide to stay put and ride out the slowdown. This will mean the number of homes for sale is unlikely to grow significantly from current levels. Given all the data discussed here, I am moving the needle more toward balance, but we are still not in a typical buyer’s market at the present time.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link