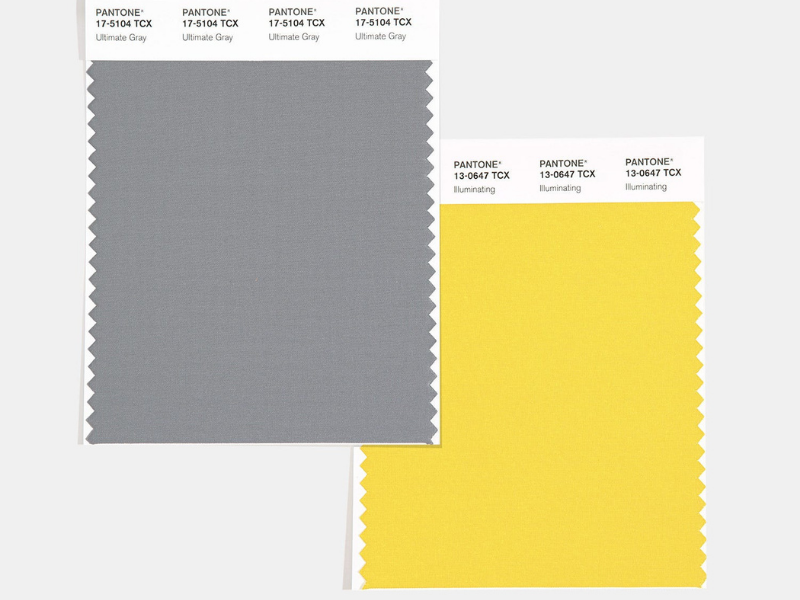

Incorporate Pantone’s Color of 2021 Into Your Home

by Sandy Dodge

For the second time ever, Pantone’s Color of the Year is actually two colors: Ultimate Gray and Illuminating Yellow. Ultimate Gray is emblematic of natural elements that stand the test of time, while Illuminating Yellow is a cheerful sunshine yellow, symbolizing energy and clarity.

Here are some ways you can harness this color harmony in your home.

Brighten Your Bedroom

Brighten Your Bedroom

With a foundation of Ultimate Gray, Illuminating yellow will brighten your bedroom, livening up the space and radiating positivity. Mix and match different furniture and accent wall combinations to get the right balance of sunny yellow and solid gray.

Refresh Your Home Office

Home offices have become more important than ever. As working from home continues in 2021, your remote workspace is the perfect location to add in Pantone’s Color of the Year. We all could use some added stimulation to keep our workdays going smoothly and productively. Use Illuminating to add some colorful accents or to paint your wall, balance it out with some Ultimate Gray, and let the positivity fill your home office. A modern home office with a yellow wall.

Accents In Your Living Room

Pantone’s Illuminating is a perfect accent color for your home. Incorporate this energetic sunshine yellow in your living room in the form of decorative throw pillows, blankets, and accent décor pieces like vases and curtains. Ultimate Gray is a perfect color for large furniture items and will help to balance out the tone of your living room. It provides a neutral backdrop, which gives you the freedom to decorate brightly.

Make A Statement With Your Front Door

Your front entrance plays a significant role in the first impressions of your home. What better way to use Pantone’s striking yellow than a front door makeover? Illuminating yellow presents an opportunity to bring a little sunshine to your family and guests every time they approach. Ultimate Gray as both a wall color and an accent color will help to solidify your new, strikingly optimistic front door. Accent pieces like house numbers, your mailbox, and plant pots will help create harmony between the two colors. A yellow front door against a gray wall.

Read more about this year’s color trends and how you can incorporate them into your home here: 2021 Paint Color Trends

Idaho Real Estate Market Update

The following analysis of select counties of the Idaho real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Powerhouse Group agent at 208-920-5966.

ECONOMIC OVERVIEW

OVERVIEW

It appears as if the significant COVID-19-induced contraction in employment Idaho experienced earlier this year is behind us (at least for now). Statewide employment declined modestly in March, but April was the real shock, with the loss of more than 78,000 jobs in the month, a decline of 10.2%. However, the economy appears to have turned around remarkably quickly, with a solid increase of 24,300 jobs in May. Idaho did see COVID-19 cases rise significantly in June, but the latest data appears to suggest that the trend has started to reverse. If this continues, I am hopeful more of the jobs lost will return.

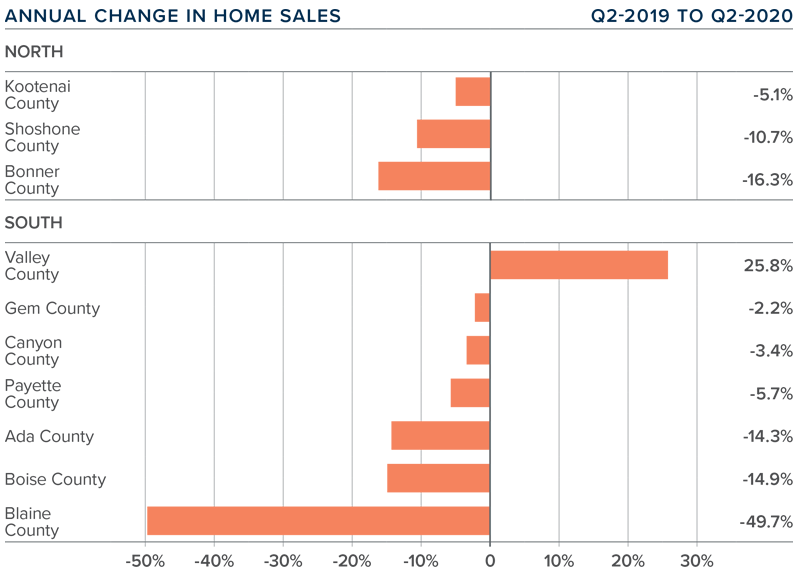

HOME SALES

- During the second quarter of 2020, 6,264 homes were sold, a drop of 10.6% when compared to the second quarter of 2019. However, I would note that sales rose 22.2% compared to the first quarter of this year.

- In the southern markets, sales rose in small Valley County, but dropped in the rest of the counties covered in this report compared to the same period a year ago.

- Year-over-year, sales growth was negative in all of the Northern Idaho counties contained in this report. The most substantial drop was in Bonner County, though the decline there amounted to only 37 units.

- Pending sales rose a significant 18% over the first quarter of the year, suggesting that closed sales will rise in the third quarter.

Matthew Gardner – Will There Be A Recession in 2020?

Windermere Chief Economist, Matthew Gardner, answers the most pressing question on everyone’s minds: Will there be a recession in 2020? Here’s what he expects to see.

If you are interested in learning more about the Idaho’s economic and real estate market forecast for 2020 from Matthew Gardner live, please join us on January 30th at JUMP in Boise from 10:00 am-12:00 pm. To reserve your spot or if you have any questions, please contact Gretchen Bolton at gbolton@windermere.com.

Idaho 2019 3rd Quarter Real Estate Economic Report

|

The following analysis of select counties of the Idaho real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact us.

ECONOMIC OVERVIEW In August, the state unemployment rate was 2.9%, marginally higher than the 2.8% rate a year ago. It cannot be disputed that the state remains at full employment. It’s also interesting to note that the employment rate remained below 3% even as the labor force rose by 2.2%, suggesting that the economy remains very strong and new entrants to the labor force are finding jobs relatively easily. |

|

|

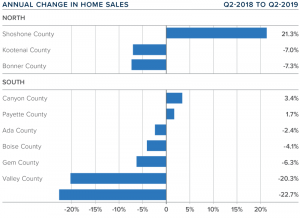

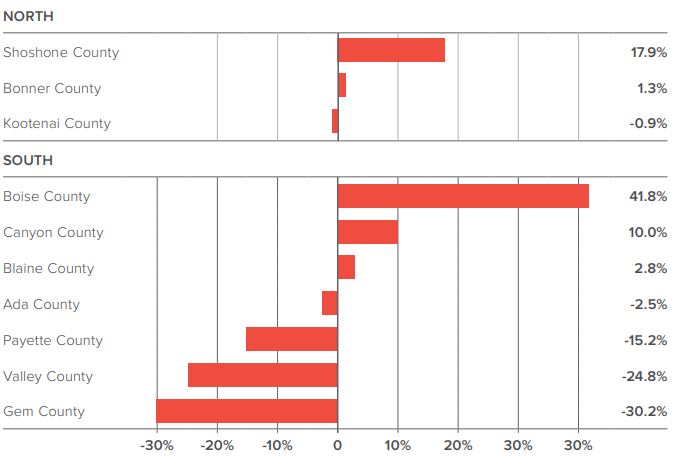

| HOME SALES | ANNUAL CHANGE IN HOME SALES Q3-2018 TO Q3-2019 |

| ❱ During the third quarter, 7,342 homes sold, representing a modest drop of 3.4% compared to the third quarter of 2018.

❱ In Northern Idaho, Shoshone County experienced a 17.9% increase in sales over the third quarter of 2018. There was a modest increase in Bonner County and a very slight contraction in Kootenai County. In Southern Idaho, sales jumped in Boise and Canyon counties. Blaine County also saw a slight increase, but sales activity was lower in the rest ❱ Year-over-year sales growth was positive in two Northern Idaho counties and three Southern Idaho counties. ❱ Pending sales rose in the third quarter, suggesting that closed sales in the final quarter of this year are likely to be an improvement over current figures. |

|

HOME PRICES

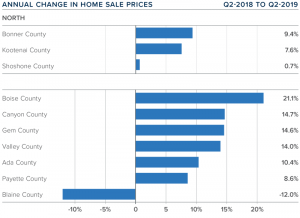

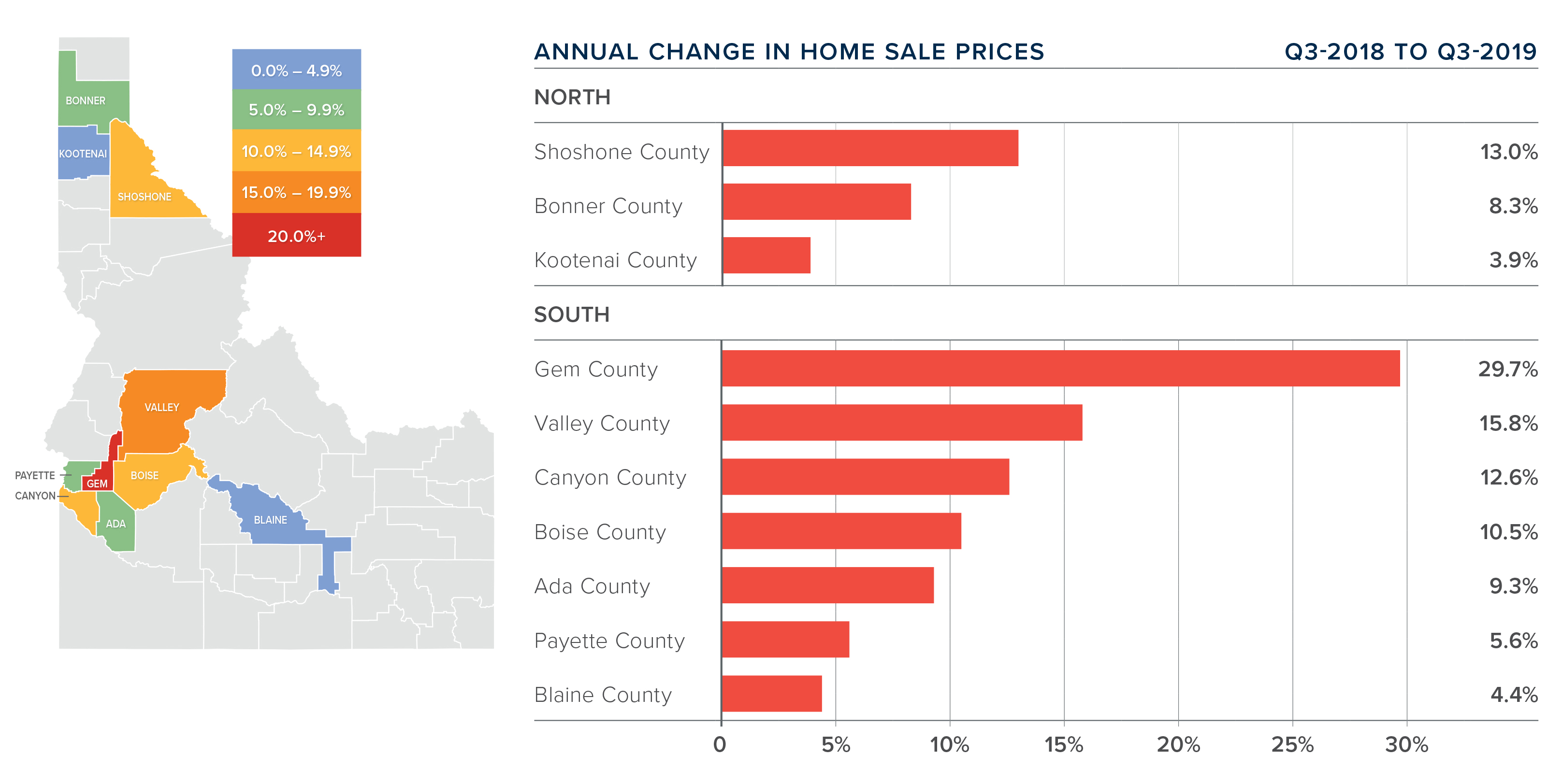

| ❱ The average home price in the region rose 8% year-over-year to $367,963. Prices were 2.7% higher than in the second quarter of this year. ❱ Prices rose in all counties compared to the third quarter of 2018. |

❱ In Northern Idaho, Shoshone County led the market with the strongest annual price growth. Bonner County also had solid price growth. In Southern Idaho, Gem County saw prices rise a very significant 29.7%, and there were notable increases in Valley, Canyon, and Boise counties. | ❱ Inventory continues to be an issue. The number of homes for sale is down 3.4% compared to the third quarter of 2018. Although listings are up 7% over the second quarter, the market remains very tight, and this is pushing prices higher. |

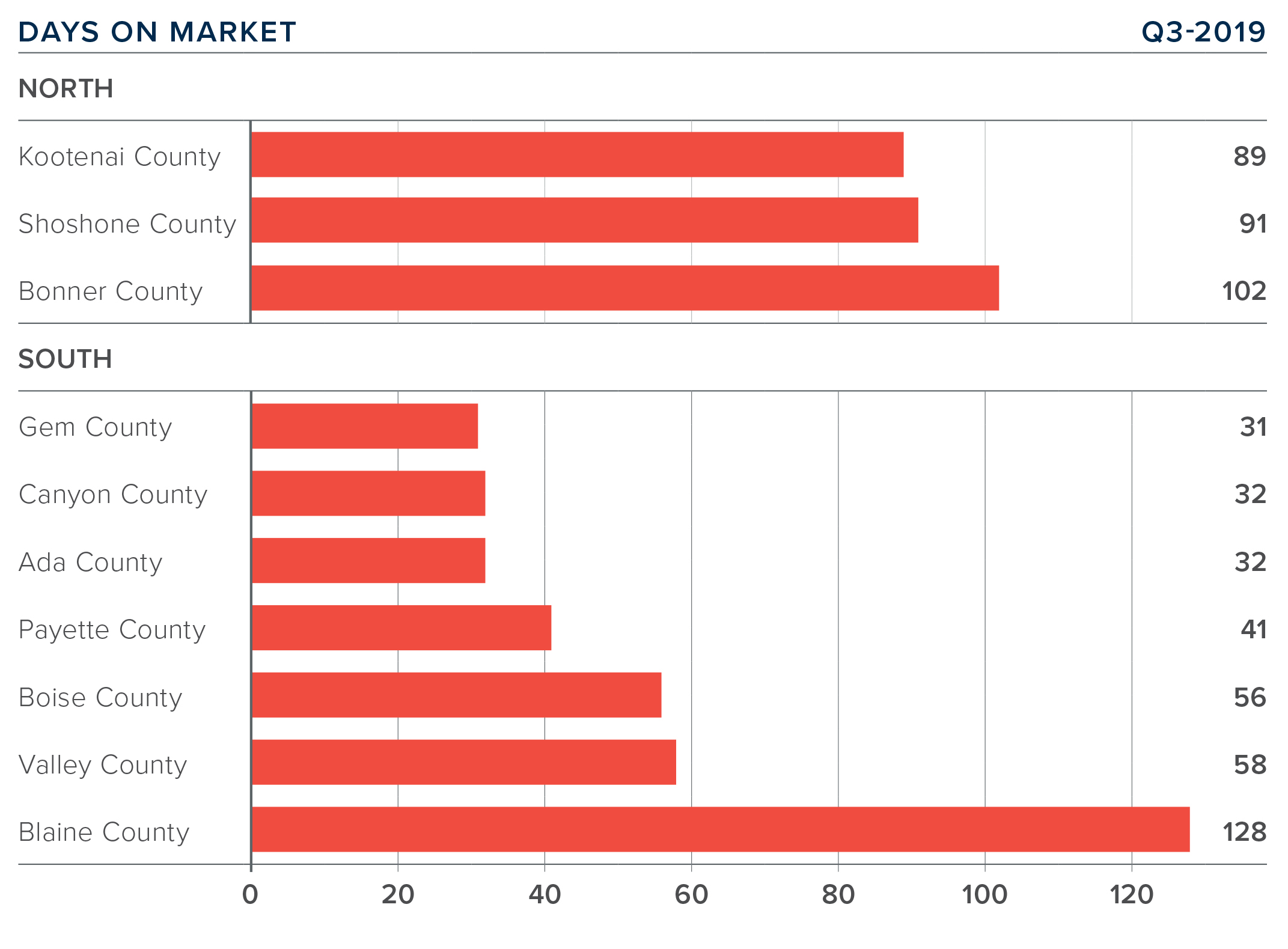

| ❱ It took an average of 94 days to sell a home in Northern Idaho, and 54 days in the southern part of the state.

❱ The average number of days it took to sell a home in the region dropped ten days compared to the third quarter of 2018. It was also ten days lower than in the second quarter of this year. |

❱ In Northern Idaho, days-on-market dropped across the board. In Southern Idaho, market time dropped in all counties except Ada and Canyon, though the rise in average market time was very modest.

❱ Homes sold the fastest in Gem, Canyon, and Ada counties. |

|

|

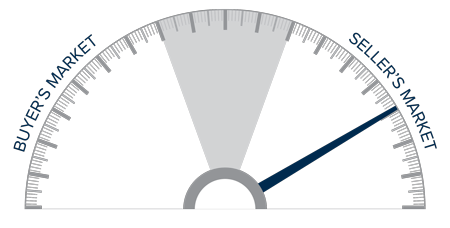

The speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Job growth continues to slow from the frenetic pace of the past few years but remains quite impressive. As is commonly known, economic/job growth leads to demand for homeownership and this continues to bode well for the Idaho market; however, home sales continue to be held back by a lack of inventory and this is leading to higher prices. As such, it remains a sellers’ market so I have moved the needle just a little more in their direction. ABOUT MATTHEW GARDNER Governors Council of Economic Advisors; chairs the Board of Trustees at the WA Center for Real Estate Research; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics. |

|

Idaho Economic Market Report

The following analysis of select counties of the Idaho real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact our office.

ECONOMIC OVERVIEW

Following a trend that started last fall, job growth in Idaho continues to moderate. The addition of 18,400 new jobs year-over-year represents an annual growth rate of 2.5%. This is to be expected at this point in the economic cycle, but it’s worth noting that the current rate of job growth remains well above the national average of 1.6%.

In May, the state unemployment rate was 2.8%, marginally lower than the 2.9% rate of a year ago. The state remains at full employment, though it is interesting to note that the employment rate remained below 3% even as the labor force rose 2%, suggesting that the economy remains very robust as there are still job openings to accommodate new workers.

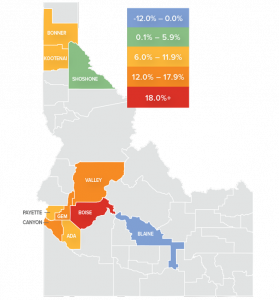

HOME SALES

- 6,936 homes were sold during the second quarter of 2019, representing a modest drop of 2.8% from the second quarter of 2018.

- In Northern Idaho, Shoshone County was the only county to experience sales growth, with sales up by 21.3% over the second quarter of 2018. There was a modest decline in sales in the other two counties. In Southern Idaho, Canyon and Payette counties had modest sales growth, but the rest of the region experienced lower sales activity.

- Year-over-year sales growth was positive in just one of the Northern Idaho counties. Sales rose in two Southern Idaho market areas relative to the same period a year ago.

- Pending sales rose in the quarter, suggesting that closed sales next quarter are likely to be an improvement over current figures.

HOME PRICES

- The average home price in the region rose 7.8% year-over-year to $358,406 and was 3.2% higher than the first quarter of this year. Continue reading…..

March 2019 Treasure Valley Real Estate Market Statistics

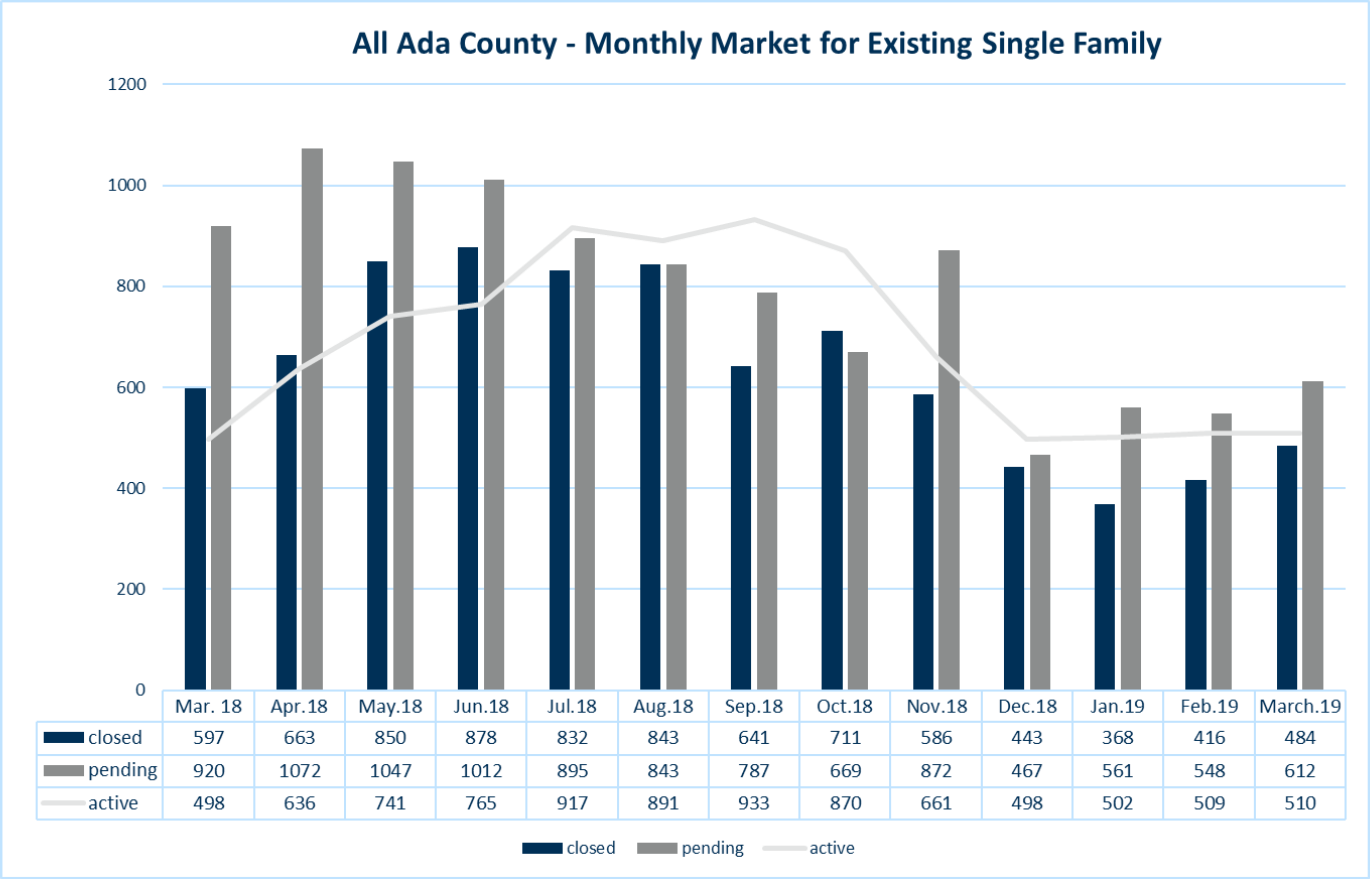

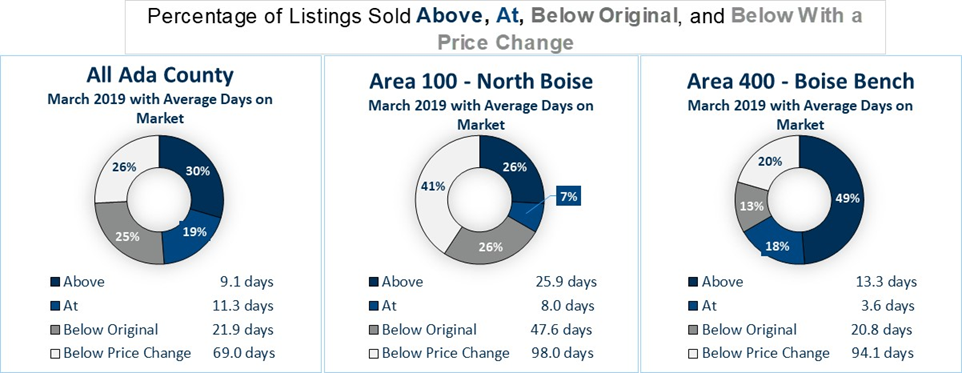

“How’s the market?” is the one question that Windermere Agents get asked most. It is the same question we ask when we meet an agent from another state. It’s a simple question with a very complex answer. Windermere Powerhouse Group knows how important it is to understand our real estate market and how curious everyone is to know what is going on in our community. So we created a market snapshot and a detailed report for every area of the Treasure Valley that will be posted monthly here on our Blog. This month we are featuring Ada County Existing Home Sales (i.e., greater than 1 year old). Links for other areas and detailed reports are below.

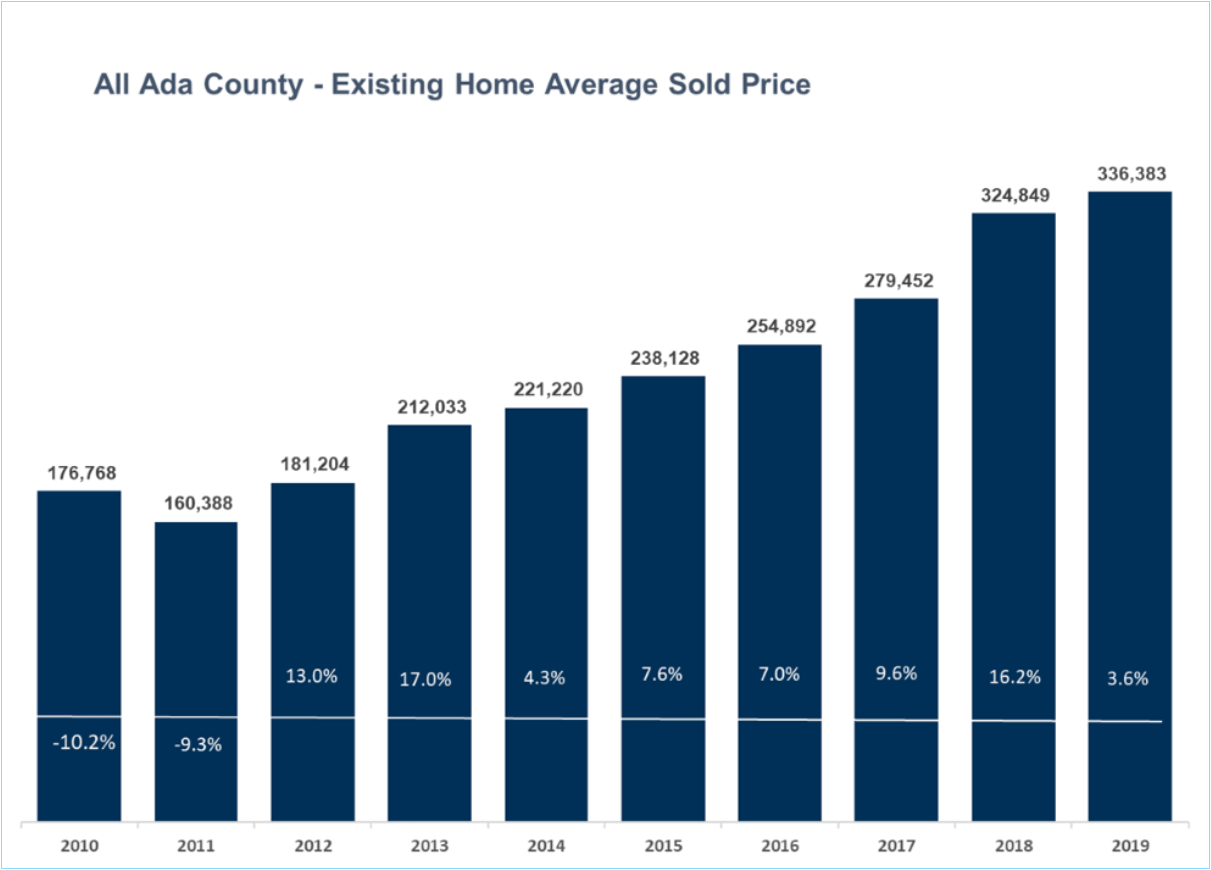

1. Spring and summer are historically the seasons when market activity increases. More homes are available for sale, and under the current market dynamics, demand immediately follows. Total Year-to-Date (YTD) 2019 transactions are down from 2018, and the shortage of supply is a major contributor. As you’ll see below, overall prices continue to increase yet days-on-market remain at historically low levels. If you are interested in buying or selling your house now is the perfect time to take action.

2. Existing home prices have risen every year since 2011 and have taken a substantial increase in the last several years. Average prices for Ada County existing homes have continued to climb in 2019, currently up 3.6%. Windermere Real Estate’s in-house economist, Matthew Gardner, forecasts 2019 Home Price growth to be 4.5% nationally, 8.9% in Ada County and 8.1% in Canyon County. So it’s actually a safe time to buy or sell a home too. Gardner forecasts the number of Ada County households to increase by 11.1% over five years, while Canyon County by 13.3% growth.

3. Last March, nearly half the existing Ada County homes that sold closed “At” or “Above” the original asking price. However, that trend varies greatly throughout the Treasure Valley. The graphs above show a snapshot of the Ada County averages compared to the North End and Boise Bench. There are numerous factors affecting a home’s price, and it’s evident that overpriced houses cost their sellers 2-3 mortgage payments last month. Specific neighborhoods have their own unique characteristics, and the REALTORS® at Windermere Powerhouse Group each possess the expertise and data to lead your next real estate transaction.

If you’d like more detailed information, have interest in learning more or would like a thorough valuation of your current home, we’d love to hear from you.

Specialized Areas and Construction Types

Ada County Existing Sales March 2019

Ada County New Construction March 2019

Canyon County Existing Sales March 2019

Canyon County New Construction March 2019

Your Neighborhood

The Idaho Economic Report by Matthew Gardner

The following analysis of select counties of the Idaho real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact our office.

ECONOMIC OVERVIEW

Job growth in Idaho slowed in the fall of 2018 but the state added 13,200 new jobs over the past 12 months, representing an annual growth rate of 1.8%.

In November, the state unemployment rate was 2.6%, down from 3% a year ago. The state remains at full employment, which explains why we are seeing a slowdown in employment growth. I fully anticipate that the state will return to above-average growth in 2019 and continue its trend of adding jobs at well above the national pace.

HOME SALES ACTIVITY

- 5,308 homes were sold during the fourth quarter of 2018, representing a drop of 3% compared to the final quarter of 2017. Continue reading…

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link